HOW MUCH CAN I BORROW CALCULATOR

You must be asking yourself, how much can I borrow on a mortgage. Everybody starts here! You can use this calculator to get a clean and clear estimate of the maximum amount that could be available to you. If you have any other questions just get in touch with our advisors who will be happy to help!

If you are thinking about getting a mortgage, the first question you are likely to have is “how much can I borrow?”.

Our easy to use mortgage calculator will help answer this burning question by estimating how much you might be able to borrow on your own using a single income or with someone else using your joint earning power.

We have designed this calculator to give you an estimated mortgage size but also an indication of how likely it will be to get it. We search thousands of mortgage rates and each lender will have a different maximum mortgage size in mind for you so generally speaking, the closer to the limit you are, the less choice you will have when it comes to picking a lender.

We discuss this in more detail further down the page. Remember that you will need to be able to make monthly payments, not just now but also in the long term.

Once you have a figure in mind, you can head over to our mortgage comparison page to find out which mortgage deals could be best for you and arrange to talk to an expert for free mortgage advice.

In the chart below you can see the typical range of mortgage that could be available. The higher the amount you need on this scale, the less likely it is to be possible.

How do lenders assess my affordability?

Lenders will:

Review your credit file

Mortgage lenders will review your credit file in-depth to establish whether you can afford the monthly mortgage repayments. Each lender has its own scoring system and may check one or more of your credit files.

When a mortgage application is made, it leaves a mark on your file that can be seen by other lenders. Marks can count against you If there are too many and being turned down for a loan will have a negative impact on your credit file.

Look at your employment record and other indicators of stability

Lenders will look at how long you’ve been in your job and whether you have been steadily employed for a number of years. They will also look at how long you have lived at your current address and how long you have had a bank account for.

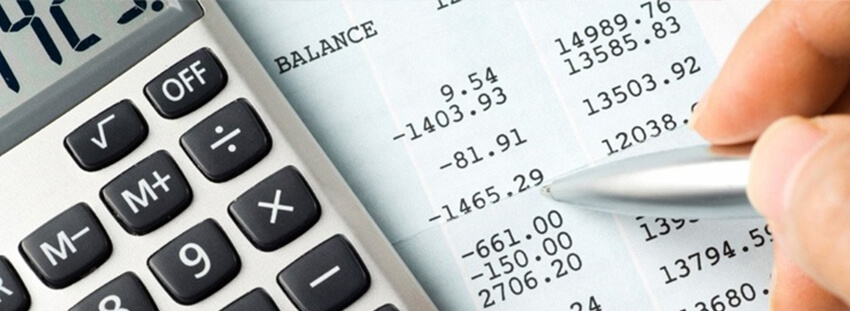

Assess your monthly income

On application, lenders will look at your salary, your guaranteed bonuses and any other income you receive. You’ll need to submit your payslips and bank statements. If you are self-employed, there is a different list of criteria which you can read about in our Mortgages for the Self Employed guide.

Carry out 'stress testing'

A lender will stress test your ability to pay monthly mortgage repayments at different interest rates. You might be able to afford the monthly payments if you secure a mortgage with a low interest rate, but lenders will want to make sure that you could afford the payments if interest rates were to go up to 3% above the standard variable rate (SVR).

They will also look at your ability to repay your monthly mortgage payments should your personal circumstances change.

What other factors will impact how much I can borrow?

- Monthly outgoings

Lenders will examine your outgoings in detail including rent or current mortgage repayments, regular bills as well as your living expenses.

They will look at how well you manage your money each month and whether you live within your means or whether you regularly go into your overdraft.

You will likely be asked about:

- Debt repayments such as credit card bills and student loans.

- Regular bills such as gas, electricity and phone.

- Transport costs

- Grocery costs

- Spending on leisure activities

Your lender will likely ask to see recent bank statements and payslips.

As previously mentioned, each lender places emphasis on different criteria.

If each lender is different, how should I use this mortgage calculator?

Our mortgage calculator can give you a pretty accurate estimation of what will be available to you and will show you 3 outcomes which represent a lower, medium and higher chance of success.

Many of our customers regularly achieve the highest loan amounts available so don’t be put off if you think you need to max out your possible mortgage size.

How to calculate your salary, bonuses, commission and overtime when using our how much can I borrow mortgage calculator

If you want to get the most accurate answer then you can follow these extra hints and tips or simply speak to one of our experts for free mortgage advice.

- Salary – This one is easy, just enter your gross (before tax) yearly salary and don’t include any additional payments.

- Annual bonuses – Calculate the average of your last 2 years bonus payments and enter this figure. If you have only had 1 years bonus so far or the latest year was much higher and you feel you have a great explanation for this then you can use this instead.

- Monthly Bonuses – Calculate the average of your last 3 months bonus payments.

- Commission – Calculate the average of your last 3 months commission payments. If it is not regular then enter your latest full years commission payments.

- Overtime – Calculate the average of your last 3 months overtime payments.

Hang on, I'm self-employed - how much can I borrow?

If you’re self-employed or have problems proving your long term income, then getting a mortgage can be more difficult. Self-certification mortgages – mortgages where you declare your own income and the lender doesn’t require proof, were common in the mid-noughties but are no longer available.

Lenders will want to see detailed proof of your income, such as:

- Business accounts. 2 to 3 years of business accounts signed off by a chartered accountant.

- Tax returns. This is the next best option if business accounts are not available.

Getting a mortgage when you’re self-employed is easier for established businesses. For those who have recently started working for themselves, it is much harder to get a mortgage and might not be possible at all.

For couples – if one partner is self-employed and the other is employed, the mortgage offer may be calculated using the employed income only.

For further information, check out our guide to self employed mortgages and head on over to our self employed mortgage calculator to get an estimate.

We then suggest you get in touch with us to discuss your situation in detail.

Some assumptions our mortgage calculator has made

In order to keep the calculator easy to use we have had to make some assumptions so please take these into account and get in touch if you feel any of them affect you particularly.

- A repayment mortgage

- A mortgage term of at least 15 years

- Your general household bills, travel costs, family size are in line with ONS averages

- Good credit history

- A deposit of at least 10% (or an LTV < 90%)

Frequently Asked Questions

When property hunting, you need to know approximately how much you are going to be able to borrow so that you can look for properties within the right price range. Using our mortgage calculator can give you a good indicator of how much you might be able to borrow.

Lenders no longer simply use an income multiplier to decide how much you can borrow. They want to know what is affordable for you in your current situation as well as if your situation changes. They will lend an amount that is affordable should there be a rise in interest rates, or you have a significant change in circumstances such as losing your job or having a child.

Lenders also have regulatory restrictions that limit how many new mortgage loans they can offer above 4.5 times a salary. A maximum of 15% of all new mortgage loans can be offered for above 4.5 times a salary.

It is possible to borrow 5 times your salary but only if you meet the lender’s strict affordability tests and requirements for loan-to-value and minimum salary. You are likely to need a deposit of at least 10% and the mortgage term may be lengthened to make monthly payments affordable.

If your overtime payment is regular and evidenced, then lenders might consider including all or part of it in their calculations. Some lenders, however, won’t include at all.

Final thoughts

Hopefully you now have a good idea of how much you can borrow. We try hard to give a reasonably accurate answer here on our mortgage affordability calculator. Remember, that all lenders operate with a different rule book, our mortgage calculator and the guidance given are designed to try and represent the most typical outcomes.

If you have a particularly complicated income package or feel the calculator doesn’t quite fit your situation then get in touch and our expert advisers will be happy to help you understand how much of a mortgage you can borrow.

Tell us about yourself with just a few steps

Click the button below if you want to view your Credit Report &

Score for FREE now!

Disclaimer: UKCreditRatings offer a 14-day trial to their credit report service. If you choose not to cancel within. The trial period, you will incur the monthly subscription fee of £19.95 until you cancel the account

Hello! I’m Matthew and I’m an expert in making, saving, and borrowing money!

Home loan mortgages, development finance, commercial lending, etc (oh the joy) were not exactly the things I dreamed of dealing with as I was growing up. But with 10+ years of financial wizardry under the belt, it has become something of a passion and outlet for providing help to those that need it.

“Knowledge is power is time is money”

The vast majority of cases are handled free of charge! However, there are some more complex situations where a fee will need to be applied.

We will ALWAYS let you know this UPFRONT and with no commitment on your part. Transparency is integral to our service.